Family Wealth Consulting Platform

Clarity provides a broad array of sophisticated Family Wealth Consulting Services that its clients may choose a la carte, including:

Information Management Services

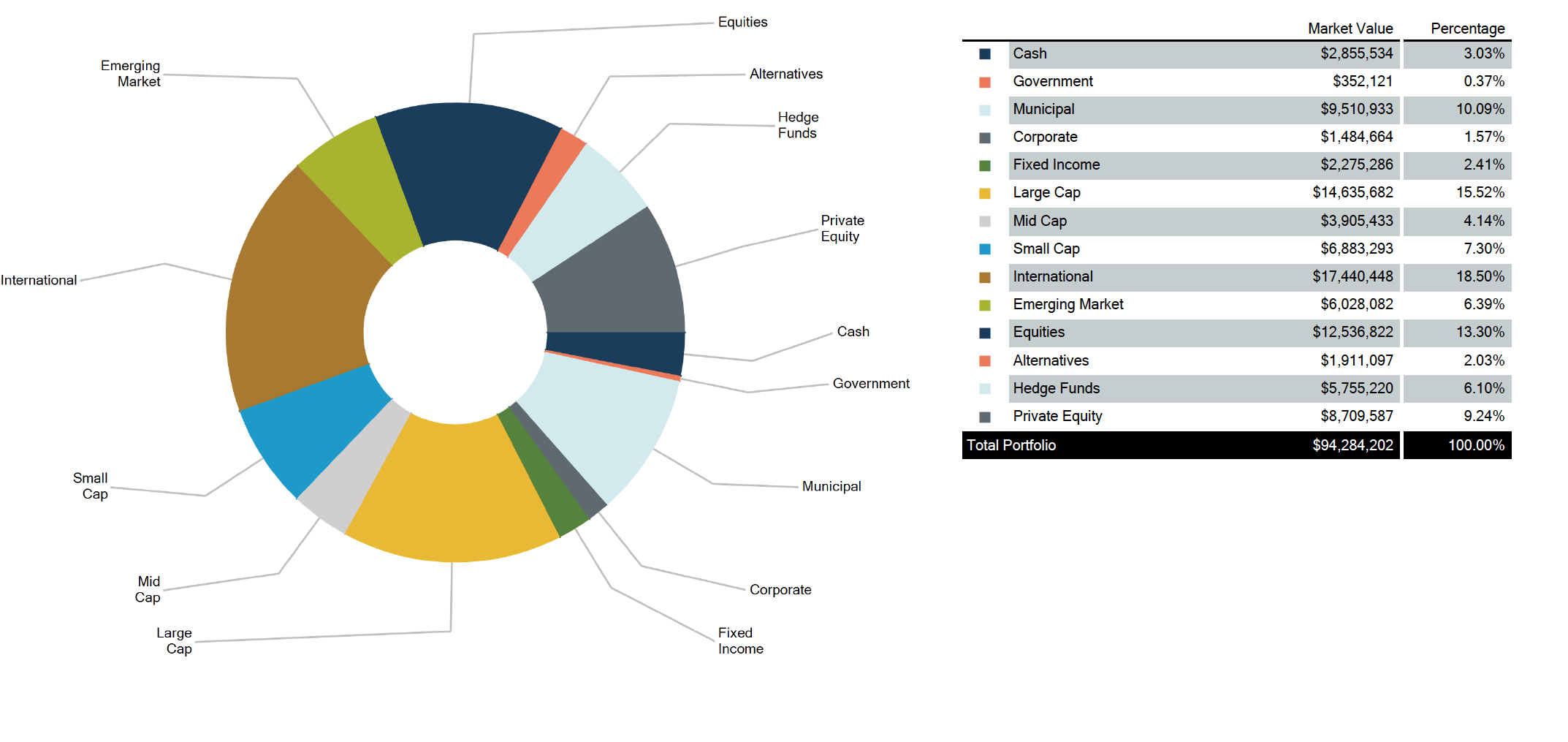

Customized and Consolidated Asset and Performance Reporting Services

o Tangible and Intangible Assets (Consolidated and Customized Family Wealth Views)

o Alternative Investment Tracking (Pacing Schedules and IRR Reports re Private Equity)

o Portfolio Performance Analytics and Performance Attribution

Family Investment LLC Sample Report

Preserve and Protect Planning

See Family Office Services for Detailed Description

o Family Administration

o Entity Administration

o Family Wealth Structure Administration

o Tax Compliance Management Services

Comprehensive and Multi-Generational Wealth Plan Development

Development of Multi-Generational Comprehensive Wealth Diagnostics

Philanthropic Services

Philanthropic Strategy Consulting

Mission and Wealth Structure Analysis (Private Foundations, Donor Advised funds, Charitable Trusts)

Entity Formation Analysis (Operating and Non-Operating Foundations)

Entity Administration (Annual Regulatory and Tax Filings)

Program Related Investments

Grant Making Administration Services

MIR Calculations

Expenditure Responsibility and Equivalency Determinations

Strategic Wealth Consulting Services

Tax Minimization Planning

Strategic Dynastic Trust Planning (e.g., SLATs/BIDITs/642(c) Charitable Trusts)

Strategic Net Worth Reduction Planning (Leveraged Wealth Transfer Planning)

Sophisticated Income Tax Planning (e.g., Derivative Based, Partnership Tax Based, Charitable Based, State-Level Tax Elimination, Capital Gain Tax Deferral-Reduction Planning, and Pre-Monetization Planning)

Family Wealth Scorecard Analysis

Innovative Wealth Solutions

Integrated Planning Solutions Achieve Leveraged Wealth Transfer, Income Tax Reduction and Portfolio Volatility Reduction (e.g., Charitable LLC Planning, Deriva-IDIT/BIDIT Planning, Private Exchange Fund Planning, PAGRADIT Planning)

Creative Charitable-Based Strategies (e.g., NDNIMCRUT/NDCRUT/NDNECT/UBTI Blocker Entities/Fiduciary Income Blockers)

Creative IRC 2036 Strategies (e.g., “Waldahl Planning”)

Equity Risk Management/Single Stock Concentration Planning (Derivative and Non-Derivative Based)

Creditor Protection Planning (e.g., Self-Settled Domestic Asset Protection Trust Planning per DAPT Statutes, Irrevocable Discretionary Trust Planning, Family Limited Liability/Partnership Investment Company Planning)

Portfolio Volatility Minimization Planning (e.g., Family Wealth Policy and Risk Policy Statements Per Tax Characterization Analysis, Cash Flow and Liquidity Constraint Analysis)